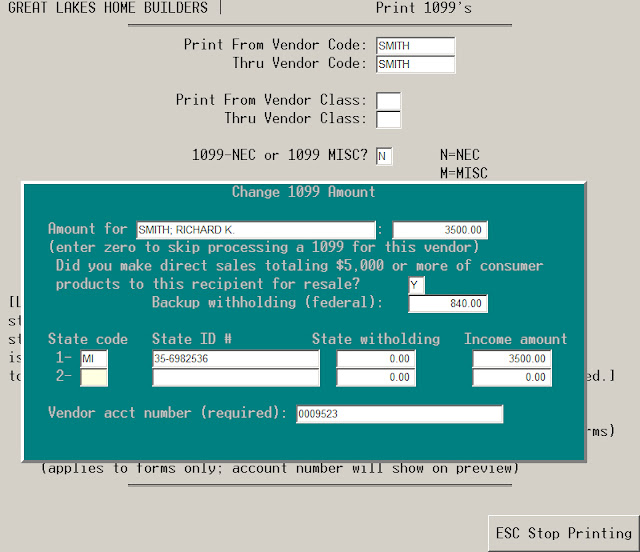

As we wind down another very active year of program development including special end user modifications and support as well as generic system-wide changes for the latest version of Advanced Accounting, we are now again devoting our attention to upcoming payroll changes; in additional we have been preparing for 2024 W-2 and 1099-NEC e-filings and have already passed the W-2 testing phase and will be ready to submit those as soon as they will be accepted on federal and state levels.

In terms of 2025 changes, we have payroll updates for all of the federal 2025 payroll tax changes (which can also be implemented by end users based on the rates on page 11 of IRS Publication 15-T which was released on December 9, 2024.

Reminder re: form W-2s for 2024: Employers filing 10 or more information returns, including Forms W-2, must file electronically (absent having received a waiver by the IRS). Information returns include commonly filed 1099 forms. Many states have similar requirements including some that are more restrictive than the federal requirements.

Social security limit changed for 2025: The social security limit will be increasing from $168,600 to $176,100 (our payroll update will make that change automatically or it can be manually updated for each payroll division in Advanced Accounting's SY-D Enter/Change Payroll/GL interface option).

State income tax withholding changes: Nine states (Indiana, Iowa, Louisiana, Mississippi, Missouri, Nebraska, New Mexico, North Carolina, and West Virginia) have reduced individual income tax rates effective January 1, 2025. See State Tax Changes Taking Effect January 1, 2025 where it is also indicates that some 39 states will be making notable tax changes in general.

In working through these changes, we have noted so far inconsistencies in the new changes (examples are Louisiana and West Virginia) which have made implementing these changes far more difficult than they should be.

Louisiana: Louisiana has changed to be a flat rate tax however the new rates are based on three options:

a. Taxpayers Not Claiming a Standard Deduction.

b. Single or Married-Separate Taxpayers Claiming the Standard Deduction ($12,500)

c. Married-Joint Return, Qualified Surviving Spouse, or Head of Household Taxpayers Claiming the Standard Deduction ($25,000).

Options (b) and (c) are the same standard deduction amounts as before even though the rest of the tax logic is different. But how does an employee "not claim" a standard deduction? The Louisiana L-4 withholding form still refers to "exemptions" but those don't exist any more. Until this is clarified, we are unable to update Louisiana's state withholding logic (although we have made some initial changes to reflect the flat tax rate and standard deduction changes).

West Virginia: There was one bill in August and another passed in October that made changes to the prior bill (SB2033). But the language of that bill isn't fully in sync with West Virginia's withholding form nor are their percentage method tables published in October 2024 consistent with SB2033. The heading categories do not match and the rates for "Two Earner jobs" (which also is inconsistent with the newer bill) do not match the SB2033 rates.

The former TWO EARNER/TWO OR MORE JOBS category for "Married filing jointly, both working/individuals earning wages from two jobs" as described in supposedly updated percentage method tables is not the same thing as married filing separately as outlined in SB2033.

And the OPTIONAL ONE EARNER/ONE JOB category formerly for "Single, head of household or married with nonemployed spouse" in the percentages tax tables is also inconsistent with SB2033's category which says nothing about a "nonemployed" spouse. Until this is clarified, updates for West Virginia are on hold (we have however gone had and made changes based on SB2033).

Other states with changes:

California: tax table changes only (extensive)

Michigan: dependent deduction ("personal exemption") increase

Missouri: tax table, logic and supplemental pay changes

Montana: tax table changes only

New Mexico: tax table changes only

Oregon: extensive internal logic changes (normal table approach doesn't work for Oregon)

Vermont: withholding allowance update and tax table changes

Virginia: standard deduction changes that were effective 4/1/24

(this blog will be updated as additional changes are identified and clarifications become available)