The IRS due date for form 1099-NEC (introduced in 2020 replacing what used to be handled by form 1099-MISC) is January 31 (unlike form 1099-MISC which has different deadlines). The form is used to report nonemployee (such as an independent contractor) payments of $600 or more. These forms can now be e-filed from Advanced Accounting.

This form can also be used to report direct sales totaling $5,000 or more of consumer products for resale anywhere other than in a permanent retail establishment. Instead, that can be "reported" informally by providing the recipient a letter with that information along with commissions, prizes, etc. Or 1099-MISC can be used to report direct sales as well.

Historically the requirement to file electronically at the federal level has been 250 returns (forms), but proposals are pending to reduce that number.

Many states have their own requirements for reporting nonemployee income paid to residents of a given state.

States with 1099-NEC requirements

The nine states that have no state income tax do not, of course, have a 1099-NEC requirement:

Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming

Two additional states also have no 1099-NEC requirement:

Illinois and New York

As a general rule, if you withhold any state taxes from an NEC-type payment, filing in that state is required. Many states only require a 1099-NEC state equivalent filing if there was state withholding on the NEC payment.

These states include:

Arizona

Arkansas (or if the payment exceeds $2,500)

Colorado

Georgia

Idaho

Indiana

Iowa

Kentucky

Louisiana

Maryland

Minnesota

Mississippi

Nebraska

North Carolina

Ohio

Rhode Island

South Carolina

Utah

Virginia

West Virginia

States that generally require 1099-NEC filings whether or not any state withholding was involved are listed below. Normally the rule also is that only residents of the state providing service in that state require a state 1099-NEC equivalent, however, there are exceptions:

Alabama - has a later deadline if there was no state income tax withheld

Delaware

California - but not required unless the state income amount is different than the federal amount

Connecticut - must file electronically if 25 or more forms

D.C. - must file electronically if 25 or more forms

Hawaii

Kansas - electronic filing is required for 51 or more forms

Oklahoma - requires a filing if the payment is greater than $750

Maine

Massachusetts

Missouri - if over $1200, unless reported elsewhere

Michigan

Montana

New Jersey - if over $1000 or state withholding; electronic filing is mandatory

North Dakota - must be filed electronically if more than 10 forms.

Oklahoma - over $750 or state withholding

Oregon - electronic filing is required if more than 10 forms

Pennsylvania

Vermont - electronic filing if more than 25 forms; forms issued to nonresidents providing services in Vermont have to be reported

Wisconsin - must be issued to nonresidents as well as residents providing services in the state

NOTE: The above information is in flux so please check with your local state agency or tax practitioner to get the latest information

Advanced Accounting 1099 form history

The first Advanced Accounting (Adv) program to produce 1099 forms was completed by Business Tools in September 1992 and released as part of the Adv 4.0 series.

We first started to make programming changes to that option in December of 1994 to provide a "magnetic media option" for a customer in North Dakota that needed it, working also initially in Adv 4.03 (TAS 4.0) which not long thereafter was migrated to Adv 5.0 (TAS 5.0) during the first half of 1995. We converted the program to version 5.0 in Dec. of 1996 and then to Adv version 5.1 (TAS 5.1) in 1997, along the way making changes for ever-changing IRS requirements as well to improve the functionality of the program such as adding a "review" option in 1998 and adding support for the 1096 transmittal in 2006 along with annual reviews and updates.

More recently, in 2020 we updated the program for the 1099-NEC change and in 2021 to print those to three, rather than two, per page.

2023 latest changes

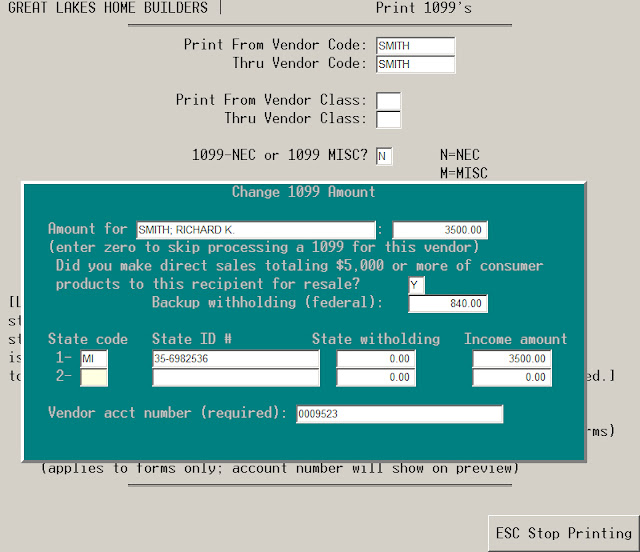

The magnetic media option that we first added in 1994 had long since fallen into disuse. But we have now implemented an interface with our e-filing partner (Nelco Solutions) that provides the ability to file electronically not only federally but also in any state. In the course of doing that, we have added support for:

Direct sales indicator

Federal (backup) withholding:

Multiple state income, state codes, tax ID's, and withholding amounts

Account number for the vendor if missing (since this is a required element)

Numerous other new features have been incorporated.

These new options are available via an "adjust" option that provides for on-the-fly entry that has been considerably enhanced.

|

| The 1099-NEC adjust/change screen |

When completed, the import file is uploaded to the same branded site that is used for e-filing W-2 forms (and the W-3 transmittal) and to accomplish state filings as well.

This option can be provided now to existing Adv 8 (and 9) users for 2022 e-filings and will be incorporated into the next update releases.

Why file electronically if it isn't required?

Filing electronically reduces the time and hassle associated with manually preparing these returns. It more securely provides the information to agencies without having to put confidential taxpayer identification numbers in the mail, and the information is more quickly and accurately processed.

Further, it obviates the need to purchase any forms. While you still have to mail the recipient a copy (printed from a provided PDF that is generated as a result of the e-filing), that is a service that can be performed by our e-filing partner. As a result, the minimal per employee filing cost is reduced even more.

So even for users with just a few 1099-NECs, there are many reasons to file electronically even if not required. In short, it saves time and frustration.