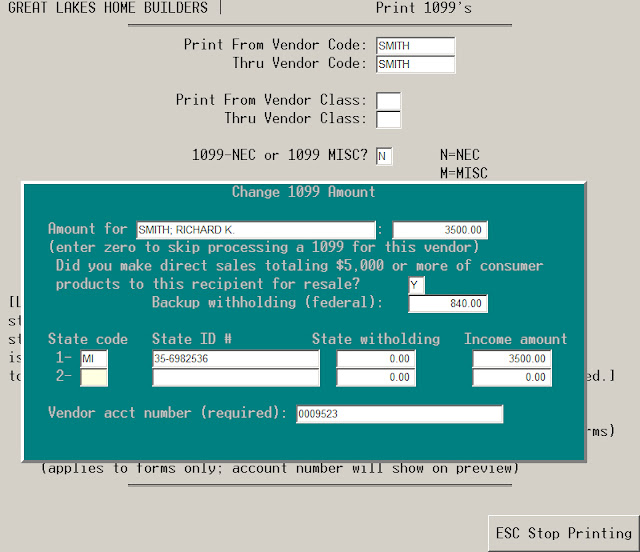

Software updates for the payroll module of Advanced Accounting version 8 are now available. These include changes that address federal and state withholding changes that are now in effect as well as some internal required changes in our e-filing interface* (which has passed a required testing phase for both W-2 and 1099-NEC forms). Our first two e-filings for 2025 were made this past Saturday (one of which was for an end user of the software).

Payroll updates for federal 2026 payroll changes that include all of the updates described in the latest IRS Publication 15-T are included including an updated tax table.

No tax on overtime and tips: This federal provision has caused considerable confusion and as worded on tax forms and in the media has been very misleading. These items are still fully reportable and subject to withholding (including social security and medicare taxes and their match) as in the past, i.e. from an employer's point of view, nothing has changed. And employees will not notice any changes in their net paychecks (absent their making W-4 changes).

Employers do have new reporting requirements. While these provisions are effective retroactively for 2025, there is no specific requirement to report them on W-2 forms (yet employers are still required to provide the applicable amounts to employees, even though there won't be any penalties for failing do to so; starting in 2026 the applicable overtime amounts will have to be reported in W-2 form Box 12 with a new code TT).

Employees will be able to report qualified overtime and tips "deductions" on Form 1040 Schedule 1-A.

Not all overtime pay is "qualified" overtime. Qualified overtime must first of all meet all of the requirements of the Fair Labor Standards Act (FLSA); in other words it must be compensation for over 40 hours in a week that is paid at 1.5 times the employee's normal rate and that is paid to non-exempt employees. In other words, the following types of overtime are NOT qualified overtime:

(1) Overtime amounts paid to exempt employees;

(2) Overtime for hours less than 40 in the employer's defined week;

(3) Overtime compensation that is paid at a rate of more than 1.5 times the employee's hourly rate.

If all of an employees overtime compensation meets all of the above criteria, then the employee would be able to claim an amount on Form 1040 Schedule 1-A that represents their total 2025 overtime pay divided by 3. In other words, only the overtime "premium" is subject to the deduction credit. So if an employee is paid $10 per hour and receives overtime at $15 per hour, $5 is the overtime premium subject to an individual tax return deduction (and in total is also subject to an overall limit). So it is not the full $15 overtime payment amount but rather only one-third of that rate, all other things being equal.

If an employer has mix of overtime rates or made overtime payments that weren't all for hours worked over 40, qualified overtime will require manual calculation.

For Advanced Accounting, in order to meet the reporting requirement for 2025, we will default the qualified overtime compensation amount in Box 14 for employee reference with the abbreviation QUAL OTC; however that amount will need to be carefully reviewed to ensure that it meets the criteria outlined above (the accounting software program allows for individual review and for changing the OTC amount). How this will be reported in 2026 will change as also previously noted.

The following link may be of some additional assistance:

https://mrsc.org/stay-informed/mrsc-insight/november-2025/no-tax-on-overtime

Reminder re: form W-2s (in effect since tax year 2024): Employers filing 10 or more information returns, including Forms W-2, must file electronically (absent having received a waiver by the IRS). Information returns include commonly filed 1099 forms. Many states have similar requirements including some that are more restrictive than the federal requirements.

Social security limit changed for 2026: The social security limit has increased from $176,100 to $184,500 (our payroll update will make that change automatically or it can be manually updated for each payroll division in Advanced Accounting's SY-D Enter/Change Payroll/GL interface option).

State income tax withholding changes: While there are nine states with no state income tax withholding, of the remaining states at least 27 states have made changes for 2026 for their state income tax withholding rates and/or related logic.. See also State Tax Changes Taking Effect January 1, 2026 (which outlines changes beyond just payroll withholding changes).

As of the date of this blog, we have made changes to Advanced Accounting 8's payroll tax tables and/or internal logic and tested those changes in the following states:

California, Colorado, Georgia, Illinois, Indiana, Kentucky, Minnesota, Missouri, Montana, Nebraska, New Mexico, New York, North Carolina, Oklahoma, Oregon, and Vermont

During this review process we have also picked up changes made mainly during the last of of 2025 for:

Ohio, Utah, Virginia, and West Virginia

It should be noted some states may parallel the federal "no tax on overtime and tips" changes at the state level, an example of which is the state of Michigan (effective also retroactively) and so employees may be able to claim a state income tax deduction.

A separate payroll-only update is now available for Advanced Accounting 8: These 2026 payroll updates will be included in the final Advanced Accounting 8 rel. 14 which will be the subject of a separate blog, however, we now have a payroll-only update that is standalone and does not require any other prior updates nor the rel. 14 update which can be implemented immediately to accommodate these changes. Contact us to arrange for installation of that update.

*For tax year 2025 W-2 forms, the employer's email address, contact name and phone number are mandatory requirements but only for electronic submissions to the Social Security Administration (SSA). The employer name and address of course are also required.